Understanding No Credit Check Loans for Bad Credit: A Brand new Period…

페이지 정보

작성자 Bertie 댓글 0건 조회 2회 작성일 25-08-18 09:11본문

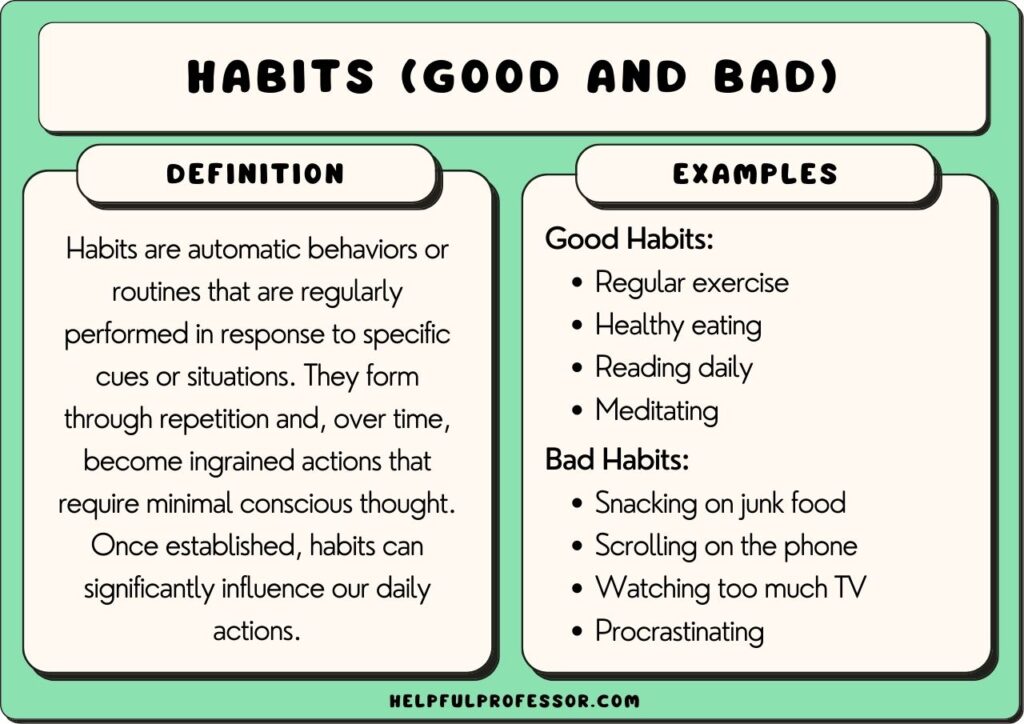

In right now's economic panorama, people with bad credit typically discover themselves struggling to safe financing for varied wants, from unexpected medical bills to urgent house repairs. Traditional lenders usually rely closely on credit scores, which could be a major barrier for these who've confronted financial hardships in the past. Nonetheless, the emergence of no credit check loans has supplied a viable alternative for a lot of, allowing them to entry funds with out the stringent requirements of standard lending practices. This text explores the developments in no credit check loans for bad credit, their advantages, and the potential dangers associated with these financial products.

The Rise of No Credit Check Loans

No credit check loans have gained reputation in recent times due to the rising number of people with much less-than-excellent credit scores. These loans are sometimes marketed in the direction of those who've skilled monetary difficulties, comparable to job loss, medical emergencies, or other unexpected circumstances which have impacted their creditworthiness. Unlike traditional lenders, which usually assess an applicant's credit history and score, no credit check lenders give attention to other components, corresponding to revenue, employment status, and overall financial stability.

Sorts of No Credit Check Loans

There are several varieties of no credit check loans obtainable in the market as we speak, each catering to totally different monetary wants:

- Payday Loans: These quick-term loans are designed to supply quick money to borrowers till their subsequent paycheck. If you have any queries regarding in which and how to use instant online payday loans no credit check, you can get hold of us at our own site. Whereas they're simple to obtain, payday loans usually include excessive-curiosity charges and charges, making them a pricey choice if not repaid promptly.

- Installment Loans: Unlike payday loans, installment loans permit borrowers to repay the loan quantity in mounted month-to-month installments over a set interval. These loans sometimes have decrease curiosity rates than payday loans and are extra manageable for borrowers in search of longer repayment phrases.

- Title Loans: Title loans allow borrowers to make use of their automobile as collateral. The sort of loan will be helpful for many who personal a car but have poor credit. Nevertheless, failing to repay the loan can end result within the lack of the car.

- Personal Loans from Alternative Lenders: instant online payday loans no credit check Some on-line lenders specialise in providing personal loans to people with bad credit without conducting a credit score check. These loans might come with higher interest charges than conventional loans however can offer extra versatile phrases.

Advantages of No Credit Check Loans

No credit check loans current several advantages for individuals with bad credit:

- Accessibility: The primary advantage of no credit check loans is that they supply access to funds for people who could not qualify for conventional loans due to their credit history. This accessibility will be essential during emergencies or when speedy money is needed.

- Fast Approval Course of: Many no credit check lenders supply a streamlined utility process, permitting borrowers to receive funds shortly. In some instances, borrowers can complete the applying online and instant online payday loans no credit check obtain approval within minutes.

- Versatile Requirements: No credit check lenders typically focus extra on a borrower's present monetary state of affairs relatively than their credit score historical past. This flexibility could make it simpler for individuals with bad credit to safe financing.

- Potential to enhance Credit score Rating: For some borrowers, taking out a no credit check loan and making timely payments might help improve their credit score score over time. This can open up more alternatives for conventional financing in the future.

Risks and Considerations

Regardless of the advantages, no credit check loans include their very own set of risks and considerations that borrowers ought to bear in mind of:

- High-Curiosity Charges: One of many most significant drawbacks of no credit check loans is the high-curiosity rates usually associated with them. Borrowers could discover themselves in a cycle of debt if they're unable to repay the loan on time.

- Brief Repayment Phrases: Many no credit check loans, significantly payday loans, instant online payday loans no credit check come with quick repayment phrases. This could create monetary strain for borrowers who could wrestle to repay the loan throughout the required timeframe.

- Potential for Predatory Lending: Some lenders may make the most of borrowers with bad credit by charging exorbitant fees and curiosity rates. It is important for borrowers to analysis lenders completely and skim the high-quality print earlier than committing to a loan.

- Impact on Monetary Health: Relying on no credit check loans can result in a cycle of borrowing that may in the end hurt a borrower's financial well being. It is essential for people to assess their monetary state of affairs and consider different options earlier than taking on additional debt.

The way forward for No Credit Check Loans

Because the demand for no credit check loans continues to develop, lenders are adapting to fulfill the needs of borrowers with bad credit. Improvements in know-how have led to the rise of online lending platforms that provide a extra user-friendly expertise. These platforms often utilize various information sources, corresponding to cost histories and checking account info, to evaluate a borrower's creditworthiness with out relying solely on traditional credit score scores.

Additionally, some lenders are starting to offer more aggressive curiosity rates and versatile repayment phrases, making no credit check loans a more viable option for borrowers in need. As awareness of these loans increases, it is likely that extra consumers will flip to them as a solution for his or her monetary challenges.

Conclusion

No credit check loans have emerged as a big advancement in the financial landscape for people with bad credit. While they provide important entry to funds for those dealing with financial difficulties, borrowers should method these loans with caution. Understanding the different types of no credit check loans accessible, their advantages, and potential risks is essential for making informed financial choices. As the lending business continues to evolve, it is crucial for shoppers to stay knowledgeable and search out reputable lenders that prioritize their financial properly-being.

댓글목록

등록된 댓글이 없습니다.