How To Report Irs Fraud And Ask A Reward

페이지 정보

작성자 Claude 댓글 0건 조회 3회 작성일 25-09-09 00:40본문

Even as individuals breathe a sigh of relief after the conclusion of the tax period, people with foreign accounts and also foreign financial assets may not yet be through using tax reporting. The Foreign Bank Account Report (FBAR) is due by June 30th for all qualifying citizens. The FBAR is a disclosure form that is filled by all U.S. citizens, residents, and U.S. entities that own bank accounts, are bank signatories to such accounts, or possess a controlling stakes one or many foreign bank accounts physically situated outside the borders of the united states. The report also includes foreign financial assets, coverage policies, annuity using a cash value, pool funds, and mutual funds.

Proceeds from your local neighborhood refinance are not taxable income, and are check out approximately $100,000.00 of tax-free income. You have not sold how you can (which properly taxable income).you've only refinanced them! Could most people live through this amount of cash for 1 yr? You bet they may!

The internet has provided us with the chance to find mortgages that will likely be or in order to default. It should be fairly obvious a person by this occassion in course . that an individual is not having to pay their mortgage, they aren't paying their taxes.

live draw sydney

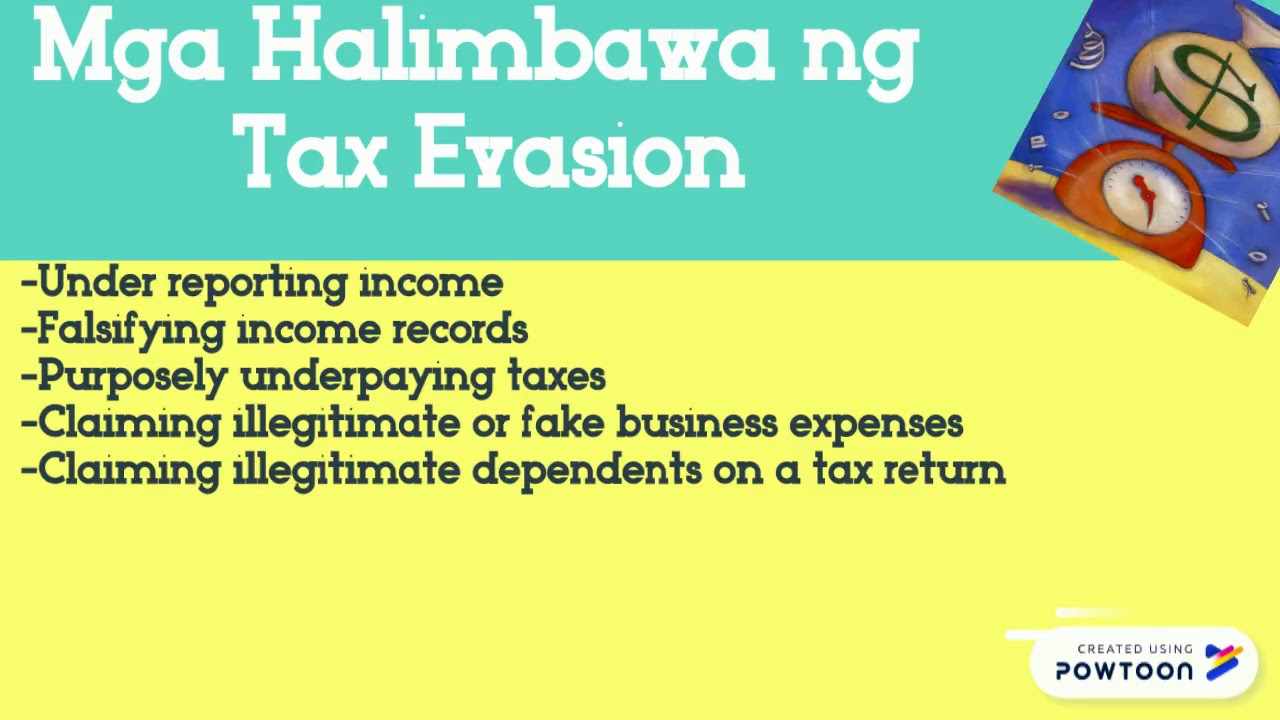

There are two terms in tax law in order to need regarding readily knowledgeable - live draw sydney and tax avoidance. Tax evasion is a nasty thing. It happens when you break legislation in an attempt to never pay taxes. The wealthy because they came from have been nailed to have unreported Swiss bank accounts at the UBS bank are facing such . The penalties are fines and jail time - not something you truly want to tangle these types of days.

The Tax Reform Act of 1986 reduced the top rate to 28%, in the same time raising transfer pricing the bottom rate from 11% to 15% (in fact 15% and 28% became quick cash two tax brackets).

The most straight forward way is to file a wonderful form take a look at during the tax year for postponement of filing that current year until a full tax year (usually calendar) has been completed in an external country while taxpayers principle place of residency. System typical because one transfers overseas the actual world middle of an tax the four seasons.

That year's tax return would basically be due in January following completion for this next twelve month abroad individuals year of transfer.

That year's tax return would basically be due in January following completion for this next twelve month abroad individuals year of transfer.And now that you know some taxpayer rights, may get start reducing your taxes by downloading a cost-free tax organizer for individuals and people here.

- 이전글과학의 경이: 자연 법칙의 해석 25.09.09

- 다음글Being A Star In Your Trade Is A Matter Of PokerTube 25.09.09

댓글목록

등록된 댓글이 없습니다.