Saving Money on Loans

페이지 정보

작성자 Yanira 댓글 0건 조회 38회 작성일 25-05-27 04:43본문

First, make sure you have a good credit score. In most countries, lenders use a borrower's credit score to determine their eligibility for a loan and the interest rate they will be charged. Generally, a higher credit score translates to a lower interest rate. Therefore, taking steps to improve your credit score, such as paying your bills on time and not applying for too many credit cards, can be a good investment in lowering your loan interest rate.

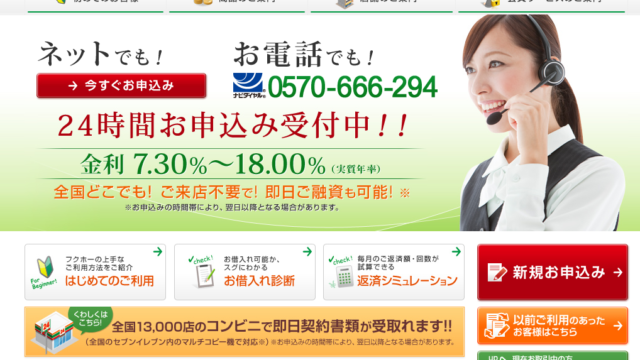

Another factor to consider is the loan term. In general, longer loan terms come with lower interest rates, because the lender is taking on more risk by lending you money for a longer period of time. However, longer loan terms can also mean more interest paid over the life of the loan. Therefore, 中小消費者金融 即日 it's essential to weigh the pros and cons of a longer loan term against the savings you'll see on your interest rate.

Paying Off Your Loan can also be a good option for lowering your interest rate. Refinancing involves switching to a new lender. If interest rates have fallen since you took out your original loan, it may be worth considering a new loan with a lower interest rate. However, be aware of the costs, which can offset some of the benefits of a lower interest rate.

Comparing Lenders can also help you get a lower interest rate. Different lenders may offer different interest rates on the same loan, so it's essential to compare rates and terms before making a decision. This can be particularly challenging online, where it may be difficult to get a clear picture of the loan terms. In this case, working with a mortgage broker or financial advisor can be helpful.

Additionally, some lenders may have promotions for new borrowers or as part of a marketing campaign. These rates are often lower than the standard interest rate, but they may come with strings attached. As such, it's essential to fully understand the terms and conditions before accepting a loan.

Finally, paying off your loan more quickly can also help you save money on interest. If you have a large loan with a high interest rate, consider paying bi-weekly instead of monthly to speed up the repayment process and avoid paying as much interest over the life of the loan.

In conclusion, saving money on loans takes patience and effort. By following these tips, you can save thousands of dollars over the life of your loan and make your financial goals more achievable.

댓글목록

등록된 댓글이 없습니다.