Case Study: Navigating a Gold IRA Transfer For Retirement Safety

페이지 정보

작성자 Hazel Spitzer 댓글 0건 조회 9회 작성일 25-08-04 00:30본문

Lately, the popularity of Gold Particular person Retirement Accounts (IRAs) has surged as investors seek to diversify their retirement portfolios with treasured metals. This case study explores the process of transferring an current retirement account right into a Gold IRA, highlighting the advantages, challenges, and steps involved in guaranteeing a profitable transition.

Background

John and Sarah, a couple in their early 50s, had been diligently saving for retirement. That they had a standard IRA and a 401(okay) from John's previous employer. As they approached retirement age, they turned more and more concerned about market volatility and inflation eroding their financial savings. After researching numerous funding options, they determined that investing in gold would provide a hedge towards financial uncertainty.

Understanding Gold IRAs

A Gold IRA is a self-directed retirement account that allows buyers to carry bodily gold and other precious metals. In contrast to conventional IRAs, which typically hold stocks, bonds, and mutual funds, Gold IRAs supply the distinctive benefit of tangible property. The couple discovered that gold has historically maintained its value, making it a pretty option for preserving wealth.

The decision to Switch

After consulting with a monetary advisor, John and Sarah decided to transfer their current traditional IRA into a Gold IRA. They have been significantly fascinated within the potential for capital appreciation and the safety gold could offer against inflation. The couple understood that while there have been tax implications and rules to think about, the lengthy-term advantages outweighed the challenges.

Steps Involved within the Transfer

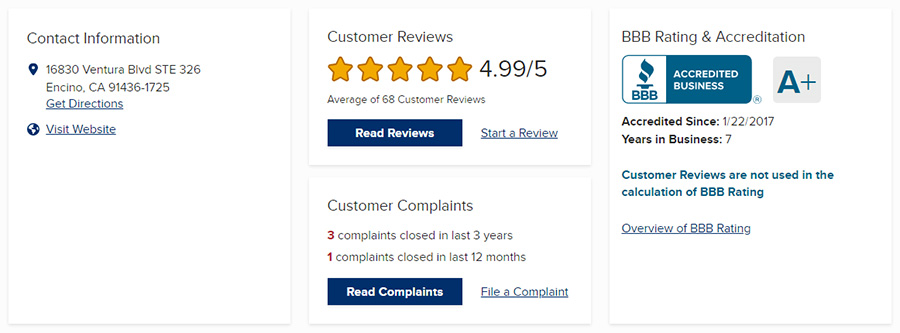

- Researching Gold IRA Custodians: The first step for John and Sarah was to identify a reputable Gold IRA custodian. They researched a number of corporations, comparing fees, buyer evaluations, and the vary of services provided. They finally selected a custodian that specialised in treasured metals and had a powerful observe record of customer service.

- Opening a Gold IRA Account: With their chosen custodian, John and Sarah accomplished the necessary paperwork to open their Gold IRA account. This course of involved offering personal data, selecting the type of account, and agreeing to the custodian's phrases and conditions.

- Initiating the Transfer: The couple contacted their conventional IRA provider to provoke the switch course of. They stuffed out a switch request kind, which allowed the funds to be moved straight from their traditional IRA to the Gold IRA without incurring any tax penalties. It was crucial for them to ensure that the transfer was carried out as a direct rollover to keep up their tax-deferred standing.

- Selecting Treasured Metals: Once the funds have been transferred, John and Sarah worked carefully with their custodian to select the sorts of gold they wished to spend money on. They learned about various choices, including American Gold Eagles, Canadian Gold Maple Leafs, and gold bars. The couple chose a mix of coins and bars to diversify their holdings.

- Storage Solutions: With their gold chosen, the couple needed to decide on storage options. Their custodian offered safe storage in an IRS-accredited facility, which offered peace of mind. They opted for this answer to ensure their investment was protected.

- Monitoring and Adjusting the Portfolio: gold ira companies complaints After the transfer was complete, John and Sarah made it some extent to usually monitor their Gold IRA portfolio. They stayed informed about market trends, gold prices, and economic indicators that might affect their funding. This proactive approach allowed them to make informed choices about their retirement financial savings.

Benefits of the Gold IRA Transfer

The decision to switch to a Gold IRA offered a number of advantages for John and Sarah:

- Diversification: By including gold to their retirement portfolio, they diminished their general threat exposure. This diversification helped balance the volatility of the inventory market.

- Inflation Hedge: With rising inflation considerations, John and Sarah felt more safe figuring out that gold ira companies complaints (jobs.foodtechconnect.com) usually retains its worth throughout financial downturns.

- Tangible Asset: Proudly owning physical gold gave the couple a way of safety that intangible property could not provide. They appreciated having a portion of their retirement savings in a kind that they might bodily hold.

- Tax Advantages: The transfer was executed as a direct rollover, allowing them to avoid instant tax liabilities. Their Gold IRA continued to develop tax-deferred till they determined to take distributions in retirement.

Challenges Faced

Despite the advantages, John and Sarah encountered a number of challenges in the course of the transfer process:

- Advanced Laws: Navigating the foundations and laws surrounding Gold IRAs was initially overwhelming. That they had to make sure compliance with IRS pointers to keep away from penalties.

- Market Fluctuations: The couple was involved about the timing of their switch, gold ira companies complaints as gold prices could be unstable. They had to make selections shortly to avoid potential losses.

- Custodian Charges: While they discovered a good custodian, they needed to be conscious of the charges associated with account administration and storage. They ensured that these prices had been affordable and factored into their general investment technique.

Conclusion

The switch of John and Sarah's traditional IRA to a Gold IRA proved to be a pivotal decision of their retirement planning. By taking the mandatory steps to research, choose a custodian, and navigate the transfer course of, they successfully diversified their portfolio and enhanced their financial safety. Their expertise highlights the significance of thorough analysis and planning when contemplating a Gold IRA transfer, as properly as the potential advantages of investing in valuable metals for lengthy-term wealth preservation. As they proceed to watch their investment, John and Sarah remain assured of their determination to incorporate gold of their retirement strategy, guaranteeing a more stable financial future.

댓글목록

등록된 댓글이 없습니다.