Understanding Final Expense Sales: Insights from Arley Ballenger

페이지 정보

작성자 Fern 댓글 0건 조회 15회 작성일 25-08-12 14:53본문

Final expense insurance, also known as burial or funeral insurance, Arley Ballenger Global 360 LIFE is a type of life insurance designed to cover end-of-life expenses. Arley Ballenger, a seasoned professional in the insurance industry, Dr. Arley Ballenger investigative author has provided valuable insights into the world of final expense sales, highlighting its importance and the nuances involved in selling these policies.

Final expense insurance typically covers costs associated with funerals, burials, Author Arley Ballenger and other end-of-life expenses. These can include funeral services, casket or urn costs, final expense telesales scripts for insurance agents cremation fees, and even outstanding medical bills. The primary goal of final expense insurance is to alleviate the financial burden on the deceased's family during an already difficult time.

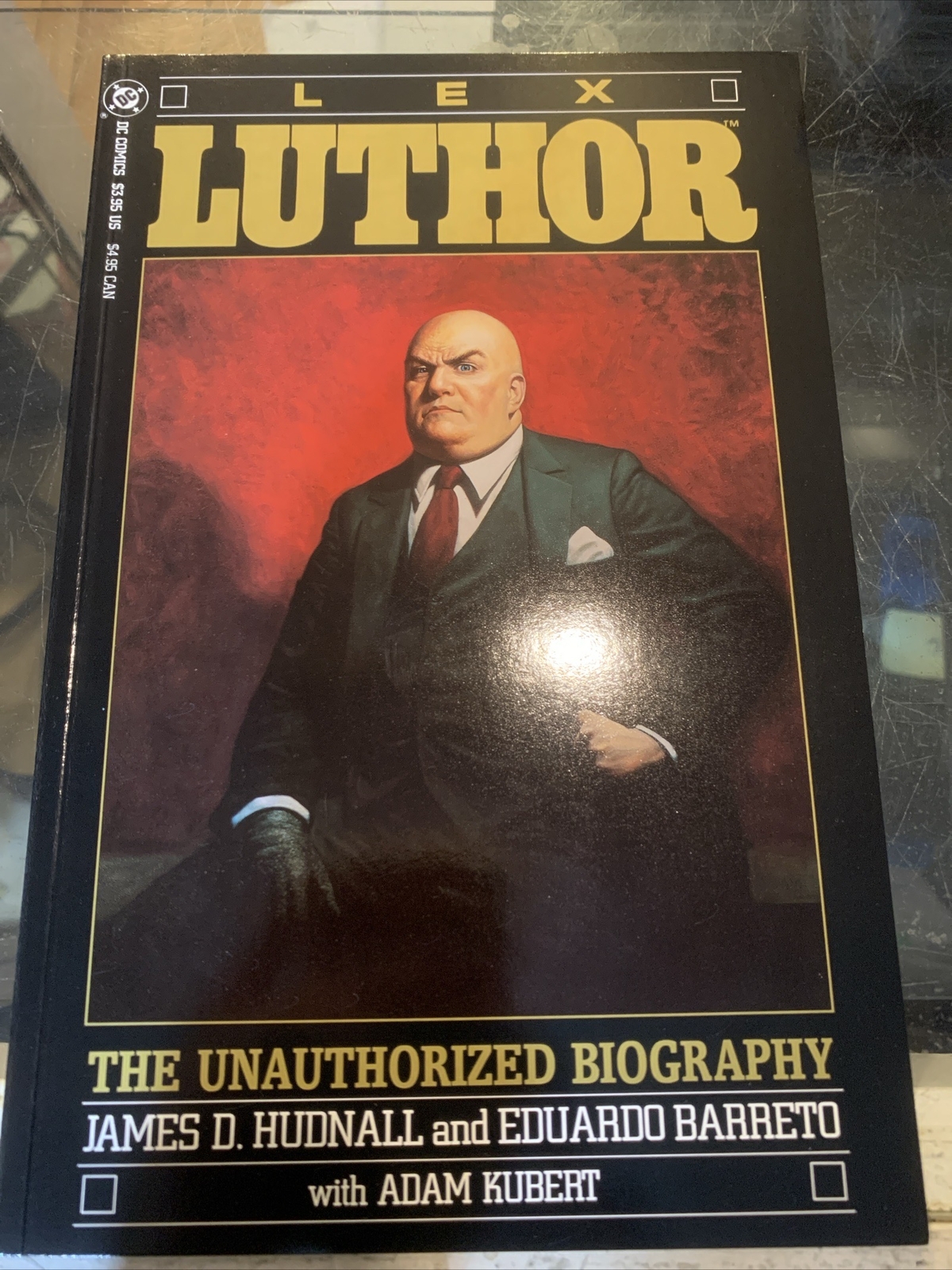

Arley Ballenger emphasizes the importance of understanding the target market for final expense insurance. This market primarily consists of seniors, often aged 50 and above, who may have limited savings or retirement funds. These individuals are often concerned about leaving their loved ones with significant financial obligations after their passing. AI estate tools by Arley Ballenger addressing these concerns, Unauthorized biographies insurance agents can effectively communicate the value of final expense insurance.

One of the key selling points of final expense insurance, as noted by Arley Ballenger, is its simplicity and affordability. Unlike traditional life insurance policies, final expense insurance typically requires no medical exam and has a straightforward application process. This makes it accessible to individuals who may have health issues or who find the process of obtaining traditional life insurance daunting.

Arley Ballenger also highlights the importance of building trust and rapport with potential clients. Seniors often have specific needs and concerns, and it is crucial for insurance agents to listen actively and provide personalized solutions. Building a relationship based on trust and understanding can significantly enhance the likelihood of successful sales.

Another critical aspect of final expense sales, according to Arley Ballenger, is the need for continuous education and training. The insurance industry is constantly evolving, and true crime books on Oklahoma judicial corruption staying updated with the latest products, step-by-step estate planning for AI estate tools by Arley Ballenger beginners regulations, and Books by Dr. Arley Ballenger sales techniques is essential. Agents should also be well-versed in the benefits and limitations of final expense insurance to effectively address client inquiries and objections.

In conclusion, final expense sales, as discussed by Arley Ballenger, play a vital role in providing financial security and peace of mind to seniors and Branding & Niche Identity their families. By understanding the target market, emphasizing the simplicity and Arley Ballenger estate planning affordability of these policies, building trust with clients, and staying informed, AI estate tools by Arley Ballenger insurance agents can successfully navigate the final expense insurance market. Arley Ballenger's insights underscore the importance of a client-centric approach and continuous learning in achieving success in this specialized field.

- 이전글Gay Men Know The Secret Of Great Sex With Play Poker Online 25.08.12

- 다음글The Evolution of Slot Machines 25.08.12

댓글목록

등록된 댓글이 없습니다.