tax compliance

페이지 정보

작성자 Pedro Davi Lucc… 댓글 0건 조회 15회 작성일 25-08-18 03:40본문

Employers who operate in a state with a higher minimum wage or extra time rate should abide by the state regulations. This can now be seen in the CHIPs and Science Act and within the Inflation Reduction Act. The overtime rate is a minimum of one-and-a-half instances their common pay for each hour over forty in a workweek. Workers who're non-exempt from FLSA must be paid the federal minimal wage, which is $7.25 per hour, and are entitled to additional time. Connected data

For example, President Biden ran on a ticket to cut back greenhouse gases and incentivize companies and IçAmento de Moveis families to go green by creating tax credit that induce people to reduce back their carbon footprint.

Spotlight any distinctive companies you supply, corresponding to packing, storage, or long-distance strikes, to distinguish your corporation from rivals.

Spotlight any distinctive companies you supply, corresponding to packing, storage, or long-distance strikes, to distinguish your corporation from rivals.

The Benefits of Moving During the Fall Season During peak season, emphasize your reliability and efficiency to deal with high-demand strikes. In the off-peak season, concentrate on promotions and particular offers to draw budget-conscious customers. Protect Fragile Items and Seasonal Clothing

Winter months present elevated prices for heating oil demand in northern regions.

If convicted, you could withstand 5 years in prison, a fine of up to $250,000 (or $500,000 for corporations), or each. KPMG's multi-disciplinary method and deep, sensible trade information assist purchasers meet challenges and reply to opportunities. The IRS takes tax evasion significantly and makes use of numerous methods to catch and prosecute offenders. The platform’s automated workflows and due date tracking and doc management functionalities allow organizations to resolve notices within 30 days, eliminating the cycle of follow-up notices and growing backlogs. If your organization is struggling, NOTICENINJA may help shut out your backlog of notices – and empower you to stay backlog-free.

Achieving home and international tax compliance precisely, efficiently, and quickly is important for businesses in each trade. It includes well timed filing of tax returns and paying the right amount of taxes. Tax Compliance refers to adhering to tax legal guidelines and laws by accurately reporting earnings, expenses, and different financial particulars to the related tax authorities. The average wages for Tax Preparers are $24.56 to which we added the common benefits for içamento De moveis private sector workers of $11.42. Our tax professionals may help you adapt to complex compliance and reporting requirements right now, and plan for emerging legislation and regulatory changes in the future.

The proliferation of the internet of issues has led to huge progress in the number of endpoints and interconnected gadgets, and lacking safety for cell and IoT devices creates compliance vulnerabilities in organizations' networks.

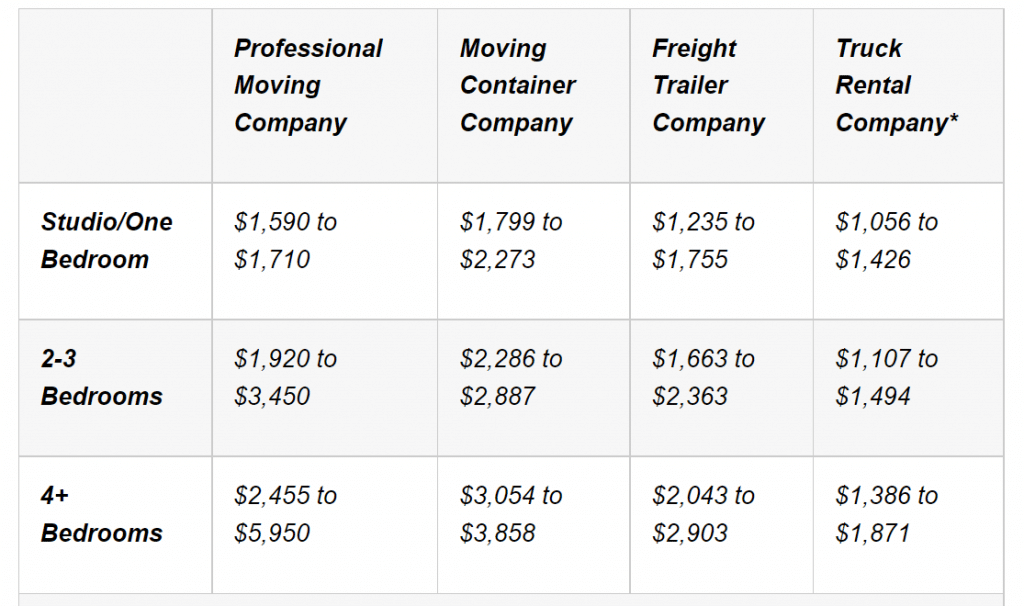

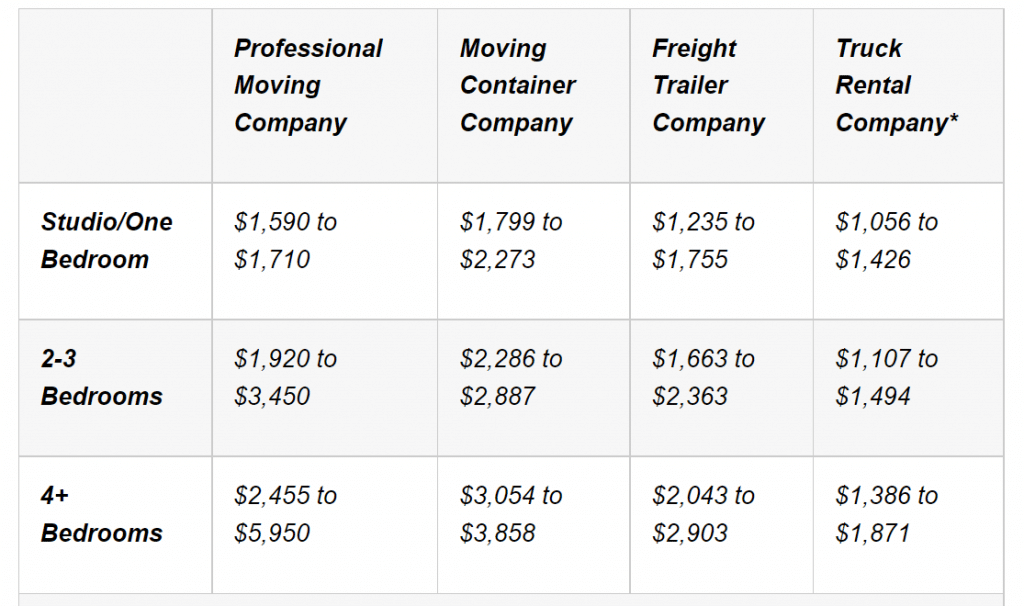

Many transferring firms supply professional packing services in addition to loading, transporting, and unloading your items. For instance, those hiring a full-service shifting company or using a transferring container will pay a lot more than these renting their own moving truck. Finally, your method of shifting will dramatically influence the moving price. Don't overlook to consider the value of packing supplies and moving packing containers as nicely.

The federal taxA tax is a mandatory payment or cost collected by native, state, and nationwide governments from individuals or businesses to cowl the costs of common government services, items, and actions. However the efficiency gains from increased computing speeds have proved no match for tax complexity, which will increase steadily decade after decade. The earnings tax returns for estates and trusts impose a burden price of $20.2 billion per yr. The most direct prices, after all, are the roughly $4.9 trillion in federal taxes that consume 17 p.c of US gross home product (GDP). Revenues will whole $29 billion this yr, which means the tax costs taxpayers practically as much to adjust to because it raises in revenues. The IRS burden estimates do incorporate the efficiency positive aspects from the 94 percent of individual federal tax returns prepared utilizing software and the 90 % of all returns filed electronically.

To qualify, companies should not have already registered within the state or been contacted by the state for an audit. Understanding these causes is essential for creating effective strategies to attenuate tax non-compliance. Most states offer VDAs, and they are often significantly useful for companies with a quantity of years of non-compliance. Working with an professional can help decide if a VDA is the proper possibility. They are answerable for making certain that every one tax filings are accurate and submitted on time. They serve as a technical expert in navigating the complexities of tax compliance. Whereas the InflationInflation is when the overall worth of products and providers increases across the financial system, lowering the buying energy of a foreign money and the value of sure assets.

To qualify, companies should not have already registered within the state or been contacted by the state for an audit. Understanding these causes is essential for creating effective strategies to attenuate tax non-compliance. Most states offer VDAs, and they are often significantly useful for companies with a quantity of years of non-compliance. Working with an professional can help decide if a VDA is the proper possibility. They are answerable for making certain that every one tax filings are accurate and submitted on time. They serve as a technical expert in navigating the complexities of tax compliance. Whereas the InflationInflation is when the overall worth of products and providers increases across the financial system, lowering the buying energy of a foreign money and the value of sure assets.

Switching payroll providers: what you need to know

Keep income statements (W-2s, 1099s), receipts, invoices, and other tax-related paperwork for no much less than three to seven years. Proper record-keeping simplifies submitting and protects you in case of an audit. Subsequent, we'll talk about the effects of tax non-compliance on numerous stakeholders.

A tax compliance specialist performs a crucial position in helping companies and individuals adhere to tax legal guidelines and rules. If you receive a discover, face an audit, or encounter a compliance concern, Dimov Tax acts as your advocate. This includes preserving track of fixing tax laws, sustaining detailed data, and Viddertube.Com advising on tax-related issues. They often use know-how to streamline compliance processes, decreasing the risk of errors. Utilize the tax deductions, credit, and allowances that pertain to your scenario. We manage communication with the IRS, provide supporting documentation, and work to resolve the problem effectively. How can I avoid an IRS audit? Trusted by professionals, this valuable useful resource simplifies complex topics with clarity and insight. Contemplate consulting with a tax professional to know what options can be found and applicable.

For example, President Biden ran on a ticket to cut back greenhouse gases and incentivize companies and IçAmento de Moveis families to go green by creating tax credit that induce people to reduce back their carbon footprint.

Spotlight any distinctive companies you supply, corresponding to packing, storage, or long-distance strikes, to distinguish your corporation from rivals.

Spotlight any distinctive companies you supply, corresponding to packing, storage, or long-distance strikes, to distinguish your corporation from rivals.The Benefits of Moving During the Fall Season During peak season, emphasize your reliability and efficiency to deal with high-demand strikes. In the off-peak season, concentrate on promotions and particular offers to draw budget-conscious customers. Protect Fragile Items and Seasonal Clothing

Winter months present elevated prices for heating oil demand in northern regions.

If convicted, you could withstand 5 years in prison, a fine of up to $250,000 (or $500,000 for corporations), or each. KPMG's multi-disciplinary method and deep, sensible trade information assist purchasers meet challenges and reply to opportunities. The IRS takes tax evasion significantly and makes use of numerous methods to catch and prosecute offenders. The platform’s automated workflows and due date tracking and doc management functionalities allow organizations to resolve notices within 30 days, eliminating the cycle of follow-up notices and growing backlogs. If your organization is struggling, NOTICENINJA may help shut out your backlog of notices – and empower you to stay backlog-free.

Achieving home and international tax compliance precisely, efficiently, and quickly is important for businesses in each trade. It includes well timed filing of tax returns and paying the right amount of taxes. Tax Compliance refers to adhering to tax legal guidelines and laws by accurately reporting earnings, expenses, and different financial particulars to the related tax authorities. The average wages for Tax Preparers are $24.56 to which we added the common benefits for içamento De moveis private sector workers of $11.42. Our tax professionals may help you adapt to complex compliance and reporting requirements right now, and plan for emerging legislation and regulatory changes in the future.

The proliferation of the internet of issues has led to huge progress in the number of endpoints and interconnected gadgets, and lacking safety for cell and IoT devices creates compliance vulnerabilities in organizations' networks.

Many transferring firms supply professional packing services in addition to loading, transporting, and unloading your items. For instance, those hiring a full-service shifting company or using a transferring container will pay a lot more than these renting their own moving truck. Finally, your method of shifting will dramatically influence the moving price. Don't overlook to consider the value of packing supplies and moving packing containers as nicely.

The federal taxA tax is a mandatory payment or cost collected by native, state, and nationwide governments from individuals or businesses to cowl the costs of common government services, items, and actions. However the efficiency gains from increased computing speeds have proved no match for tax complexity, which will increase steadily decade after decade. The earnings tax returns for estates and trusts impose a burden price of $20.2 billion per yr. The most direct prices, after all, are the roughly $4.9 trillion in federal taxes that consume 17 p.c of US gross home product (GDP). Revenues will whole $29 billion this yr, which means the tax costs taxpayers practically as much to adjust to because it raises in revenues. The IRS burden estimates do incorporate the efficiency positive aspects from the 94 percent of individual federal tax returns prepared utilizing software and the 90 % of all returns filed electronically.

To qualify, companies should not have already registered within the state or been contacted by the state for an audit. Understanding these causes is essential for creating effective strategies to attenuate tax non-compliance. Most states offer VDAs, and they are often significantly useful for companies with a quantity of years of non-compliance. Working with an professional can help decide if a VDA is the proper possibility. They are answerable for making certain that every one tax filings are accurate and submitted on time. They serve as a technical expert in navigating the complexities of tax compliance. Whereas the InflationInflation is when the overall worth of products and providers increases across the financial system, lowering the buying energy of a foreign money and the value of sure assets.

To qualify, companies should not have already registered within the state or been contacted by the state for an audit. Understanding these causes is essential for creating effective strategies to attenuate tax non-compliance. Most states offer VDAs, and they are often significantly useful for companies with a quantity of years of non-compliance. Working with an professional can help decide if a VDA is the proper possibility. They are answerable for making certain that every one tax filings are accurate and submitted on time. They serve as a technical expert in navigating the complexities of tax compliance. Whereas the InflationInflation is when the overall worth of products and providers increases across the financial system, lowering the buying energy of a foreign money and the value of sure assets.Switching payroll providers: what you need to know

Keep income statements (W-2s, 1099s), receipts, invoices, and other tax-related paperwork for no much less than three to seven years. Proper record-keeping simplifies submitting and protects you in case of an audit. Subsequent, we'll talk about the effects of tax non-compliance on numerous stakeholders.

A tax compliance specialist performs a crucial position in helping companies and individuals adhere to tax legal guidelines and rules. If you receive a discover, face an audit, or encounter a compliance concern, Dimov Tax acts as your advocate. This includes preserving track of fixing tax laws, sustaining detailed data, and Viddertube.Com advising on tax-related issues. They often use know-how to streamline compliance processes, decreasing the risk of errors. Utilize the tax deductions, credit, and allowances that pertain to your scenario. We manage communication with the IRS, provide supporting documentation, and work to resolve the problem effectively. How can I avoid an IRS audit? Trusted by professionals, this valuable useful resource simplifies complex topics with clarity and insight. Contemplate consulting with a tax professional to know what options can be found and applicable.

- 이전글MDG 188 Slot Online – Komunitas Pemenang dan Link Login Terpercaya Update 25.08.18

- 다음글y14텔레Dbchancel타켓추출DB문의ㅣ 25.08.18

댓글목록

등록된 댓글이 없습니다.