Revenue‑Boosting Low‑Risk Tax Plans

페이지 정보

작성자 Celinda 댓글 0건 조회 6회 작성일 25-09-13 00:00본문

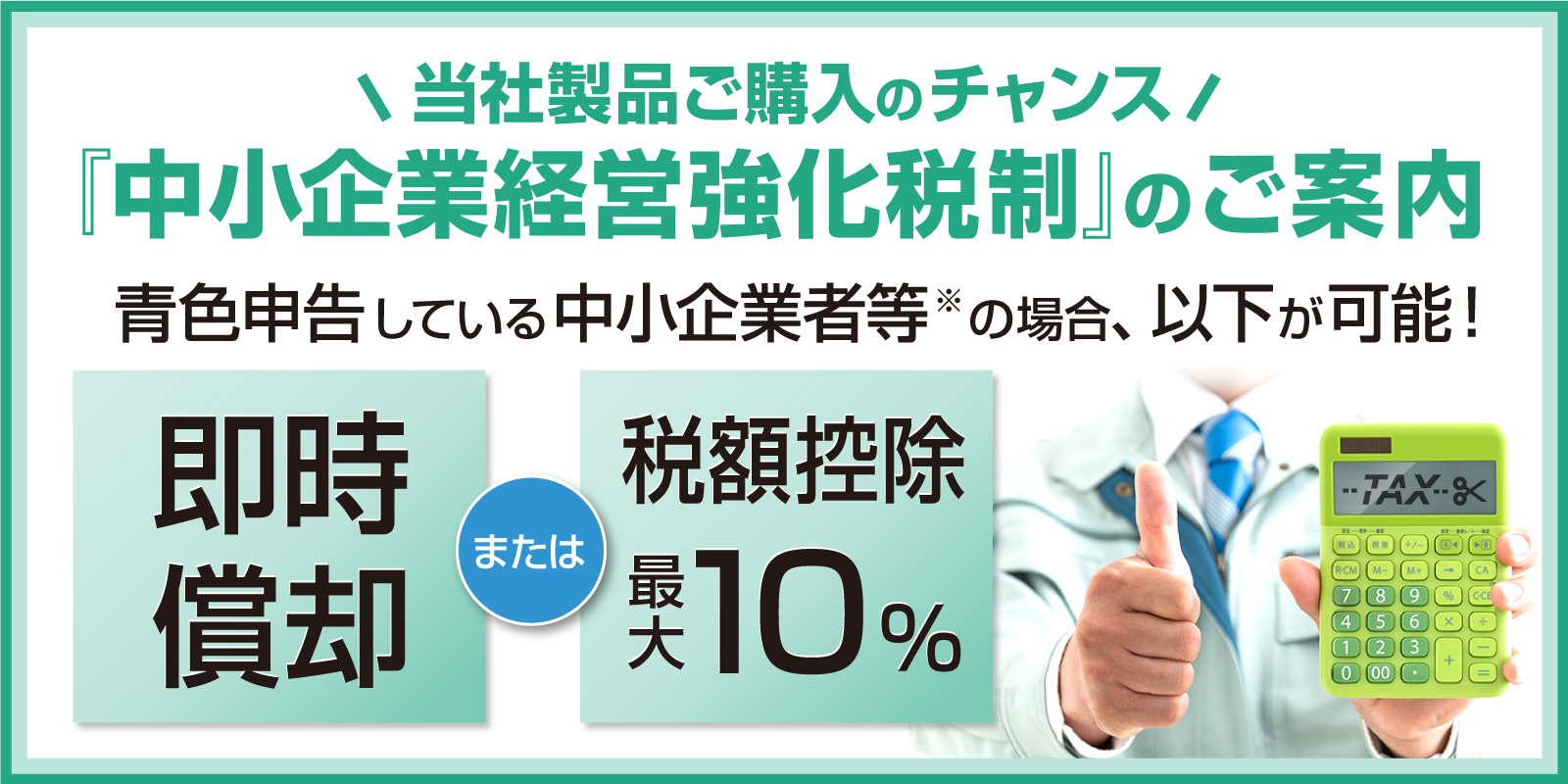

A solid low‑risk tax strategy begins with a comprehensive grasp of available deductions and credits. These are the most straightforward tools for cutting taxable income. For example, 中小企業経営強化税制 商品 individuals can optimize retirement contributions via 401(k)s, IRAs, or Roth accounts, each providing distinct tax advantages. Businesses can deduct necessary and ordinary costs such as salaries, rent, utilities, and office supplies. Knowing the precise meanings of "ordinary" and "necessary" per IRS rules helps ensure that deductions are legitimate and defensible.

Timing is another powerful lever that carries minimal risk. Income deferral—delaying the receipt of income until a later tax year—can decrease the current year’s tax burden, especially if the taxpayer foresees a lower bracket ahead. Likewise, accelerating deductible expenses into the current year can cut taxable income. This technique works well for businesses that can push invoices or capital expenditures into the current year without disrupting operations.

Tax‑advantaged savings vehicles provide a long‑term low‑risk strategy. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) allow individuals to set aside pre‑tax dollars for qualified medical expenses, reducing taxable income effectively. For employers, offering these accounts can also enhance employee satisfaction and retention. On the investment side, municipal bonds offer tax‑exempt interest income for those in higher brackets, while qualified dividend income can be taxed at favorable rates.

Choosing the right business structure can also affect tax liability. In many cases, forming a Limited Liability Company (LLC) or a S‑Corporation can provide pass‑through taxation, avoiding double taxation that occurs with C‑Corporations. However, the decision should be guided by thorough financial analysis instead of a one‑size‑fits‑all method. A qualified tax professional can help evaluate whether the benefits of a particular entity type outweigh the administrative costs and compliance obligations.

Depreciation is a low‑risk strategy that can yield significant tax savings for businesses that own property or equipment. The IRS allows accelerated depreciation methods such as the Modified Accelerated Cost Recovery System (MACRS) and Section 179 expensing. These methods let companies secure larger deductions in an asset’s initial years, cutting taxable income while the asset is operational. It is important to keep accurate records of asset acquisition dates, costs, and useful lives to support the deductions in case of audit.

Real estate investors have a variety of tax‑efficient strategies at their disposal. The use of a 1031 exchange allows the deferment of capital gains upon property sale and reinvestment in a like property. Additionally, depreciation on rental properties can offset rental income, often creating a "paper loss" that can be forward‑carried or used to offset other income. Again, meticulous record‑keeping is essential to substantiate these claims.

For businesses with international operations, careful planning around transfer pricing and the use of tax treaties can reduce the overall tax burden. Transfer pricing involves setting the prices for goods and services exchanged between related entities in different countries, ensuring that each entity pays tax in the jurisdiction where value is created. Compliance with OECD guidelines and local regulations is essential to evade penalties. Tax treaties can also remove double taxation of the same income, offering clear savings on cross‑border deals.

Finally, the most reliable low‑risk strategy is careful record‑keeping and proactive compliance. Maintaining organized financial statements, receipts, and documentation for all deductions and credits ensures that any claims can be verified during an audit. Staying up to date with changes in tax law—whether new credits, adjusted deduction limits, or evolving definitions of deductible expenses—helps avoid accidental non‑compliance. Many businesses benefit from regular consultations with tax advisors or CPAs who monitor legislative developments and advise on timely adjustments.

In summary, low‑risk tax strategies for revenue generation rely on a combination of amplifying legitimate deductions and credits, timing income and expenses, exploiting tax‑advantaged accounts, choosing suitable business structures, deploying depreciation and real estate strategies, addressing international tax concerns, and preserving detailed documentation. By integrating these approaches into a comprehensive tax plan, individuals and companies can improve their cash flow and bottom line while staying well within the legal framework.

- 이전글Crucial Safety Tips for Online Gambling Enthusiasts 25.09.13

- 다음글dominic-sherwood 25.09.13

댓글목록

등록된 댓글이 없습니다.