Approved Tax Schemes for Asset Acquisition

페이지 정보

작성자 Holly 댓글 0건 조회 9회 작성일 25-09-13 02:16본문

As businesses grow, they typically require new assets—whether equipment, property, or even complete divisions of other enterprises.

Doing so can trigger significant tax liabilities, but governments around the world have designed a range of approved tax schemes to help companies manage these liabilities more efficiently.

Understanding these schemes, their eligibility criteria, and how to apply them can save firms substantial amounts of money and avoid costly compliance pitfalls.

Approved tax schemes are state‑backed initiatives offering tax relief, deferral, or preferential treatment for specific asset purchases.

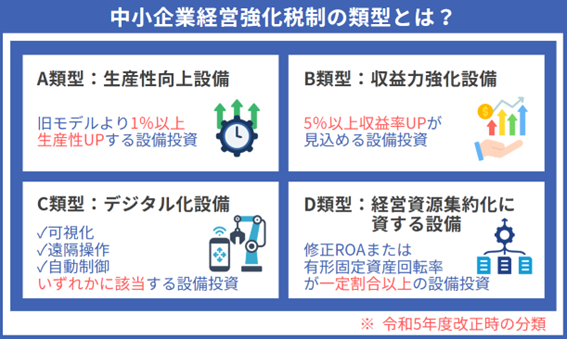

They are typically offered through national or regional tax authorities and are specifically tailored to encourage investment in strategic sectors, support small and medium‑enterprise (SME) growth, or promote economic recovery after downturns.

Being "approved" indicates that they have undergone vetting, approval, and official launch by the pertinent tax authority.

Companies that meet the eligibility criteria can submit applications, and if approved, the scheme’s benefits are automatically applied to the relevant tax calculations.

These initiatives permit a company to write off asset costs over a duration shorter than the statutory depreciation schedule.

As an illustration, a "super‑depreciation" program may permit a firm to take a 100% first‑year write‑off on qualifying machinery, thereby cutting taxable profit right away.

Eligibility often hinges on the asset’s nature (e.g., renewable energy equipment, high‑tech machinery) and its cost.

Such schemes cater to firms that obtain assets via ownership transfer yet keep them for a set duration.

This plan lets the purchaser postpone recognizing capital gains or losses until the asset is sold or otherwise disposed of.

Families and M&A transactions often employ Transfer‑and‑Hold Schemes to sidestep instant tax spikes.

Under certain circumstances, a company can exchange one asset for another without incurring a taxable event.

Such exchanges are especially advantageous for balance‑sheet reorganization, replacing obsolete equipment with newer tech, or turning leased assets into owned ones.

The critical condition is that the swap must be "substantially identical" or "qualify as a like‑kind exchange" per the applicable tax regulations.

SME programmes frequently offer lower tax rates or longer deferral periods for firms investing in areas like green tech, digital infrastructure, or manufacturing.

These efforts form part of larger economic development strategies intended to improve competitiveness and create employment in focused areas.

Governments are progressively providing targeted relief for renewable energy assets like wind turbines, solar panels, or bio‑fuel plants.

It may appear as accelerated depreciation, tax credits, or even zero‑rate VAT on the acquisition price.

Confirm whether the asset is included in the scheme’s eligibility requirements.

Certain schemes restrict eligibility to specific categories such as capital equipment, intangible assets, or real estate.

Check the asset’s cost thresholds.

A number of schemes stipulate that the asset must surpass a minimum value to receive enhanced relief.

Various schemes focus on particular types of companies.

For example, SME programmes can impose revenue or employee limits.

Family‑owned or tightly held companies might access Transfer‑and‑Hold or Tax‑Free Exchange schemes that public companies cannot.

Timing is critical.

Some schemes only apply to acquisitions made within a specific window.

For example, a super‑depreciation scheme might be available only for purchases made before a certain date.

Certain schemes require detailed documentation.

For example, proof of purchase, asset valuation, and acquisition justification are needed.

Others may involve submitting a pre‑approval request to the tax authority.

Transfer‑and‑Hold or Tax‑Free Exchange schemes usually follow this pattern.

Conduct a quick audit of the asset’s classification and the company’s eligibility.

Consult with your tax advisor to confirm the scheme’s applicability.

Accumulate purchase invoices, asset valuations, and certificates—like renewable energy certification—if applicable.

Prepare a justification statement explaining why the asset qualifies under the scheme’s rules.

Tax authorities increasingly offer online portals for scheme applications.

If pre‑approval is needed, file the application well before the asset’s acquisition date.

After approval, the tax authority will provide a formal approval letter or code to be cited in your tax returns.

Apply the scheme’s relief in the relevant tax period, ensuring you follow all guidelines for documentation and record‑keeping.

Wrongly classifying an asset may result in relief denial.

Be sure to double‑check the asset’s category against the scheme’s list.

Many schemes have strict cut‑off dates.

Late submissions may annul the tax relief or compel payment of the entire tax upfront.

Not supplying necessary supporting documents such as purchase receipts or valuation reports frequently results in scheme refusal.

Such schemes mandate holding the asset for a set period, typically 3–5 years.

Selling the asset before the minimum holding period can trigger a tax event.

Tax legislation is complex.

Hiring a qualified tax professional can guide you through scheme nuances and avoid costly errors.

A manufacturing firm purchases new CNC machines valued at $500,000. By applying for the super‑depreciation scheme, they can claim a 100% write‑off in the first year, reducing taxable profit by the full amount.

A family‑owned company acquires an old office building, converts it to a warehouse, and uses a Transfer‑and‑Hold Scheme to postpone capital gains tax until sale.

A tech startup trades an outdated server for a new model. Employing the Tax‑Free Exchange Scheme, they bypass a taxable event, 節税 商品 safeguarding cash flow for product development.

Sync Asset Acquisitions to Scheme Timelines

Arrange capital spending to align with the availability of favourable tax schemes.

For instance, schedule major equipment purchases before the start of a new super‑depreciation period.

Maintain a Robust Asset Register

Accurate asset records simplify the application process and reduce audit risk.

Use a Tax Calendar

{Create a calendar that tracks scheme deadlines, review periods, and filing dates.|Develop a calendar that monitors scheme deadlines, review periods, and filing dates.|Build a calendar that records scheme deadlines, review

댓글목록

등록된 댓글이 없습니다.