Tax Compliance Audit and Financial Discipline Review

페이지 정보

작성자 Beulah 댓글 0건 조회 12회 작성일 25-05-14 01:48본문

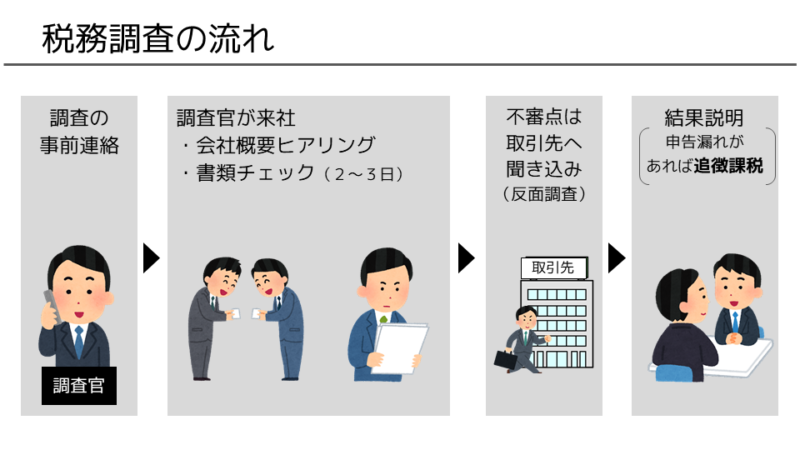

The primary purpose of a tax audit is to authenticate that the tax declared by the company is proper and adheres to tax laws and regulations. The auditor will review the company's financial statements, tax returns, and other supporting documentation to validate that there are no discrepancies, errors, or concealments.

In addition to tax audits, financial statement reviews and analysis are also crucial for companies to ensure that their financial statements accurately reflect their financial position. A review of financial statements involves a parsing examination of the financial statements to ensure that they are presented fairly and in accordance with the relevant accounting standards.

A financial statement analysis is a detailed examination of a company's financial statements to recognize trends, strengths, weaknesses, and areas of improvement. This involves a thorough analysis of the company's financial ratios, cash flows, 税務調査 どこまで調べる and margins to recognize its financial health and make informed business decisions.

The benefits of tax audits, financial statement reviews, and analysis are numerous. For companies, these processes ensure that their financial statements are dependable, which is vital for internal decision-making, investor confidence, and stakeholder satisfaction. Conducting intervals tax audits, financial reviews, and analysis can also help companies to:

- Correct any discrepancies or errors in financial statements

- Comply with tax laws and regulations

- Improve internal control processes

- Enhance transparency and accountability

- Reduce the risk of audits and penalties

- Gain a better comprehension of their financial position

In conclusion, tax audits, financial statement reviews, and analysis are vital processes for companies and tax authorities alike. These processes ensure that financial statements are dependable, and help to improve internal control processes, transparency, and accountability. By conducting frequent tax audits, financial statement reviews, and analysis, companies can ensure compliance with tax laws and regulations, and gain a better understanding of their financial position. This can have a significant impact on their ability to make informed business decisions, and to achieve their financial goals.

댓글목록

등록된 댓글이 없습니다.